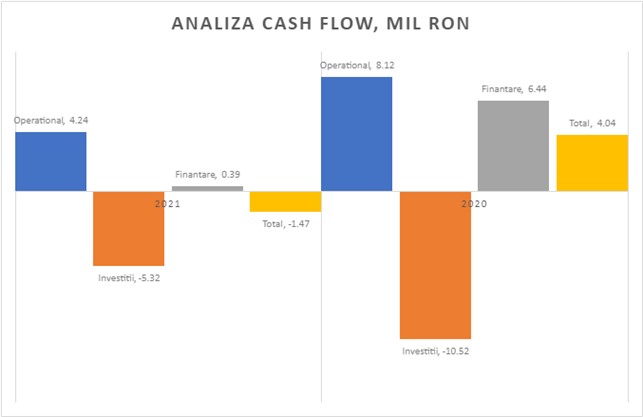

The operational activity generated, RON 4.24 million. 2016 continues to be the only year in the company’s history in which the operational cash flow did not register a positive value.

The financing activity was approximately neutral, the year starting with accessing a round of “equity” funding amounting to just over RON 10.4 million, and during the year we fully repaid the bond issue BNET22 (RON 4.5 million), repaid bank loans in amount of RON 1.9 million, we paid total interests of RON 3.2 million and leasing debts of approximately RON 1.2 million.

The “game” of these figures allowed us to increase the investment activity by another RON 4 million compared to last year – making a total payment of almost RON 14.2 million, but also to end the year with a cash position approximately equal to the beginning of the year!

We mention that the CAPEX investment needs for maintenance are specific to the IT sector in which we perform our activity – around 1% of annual turnover.