A message from the CEO

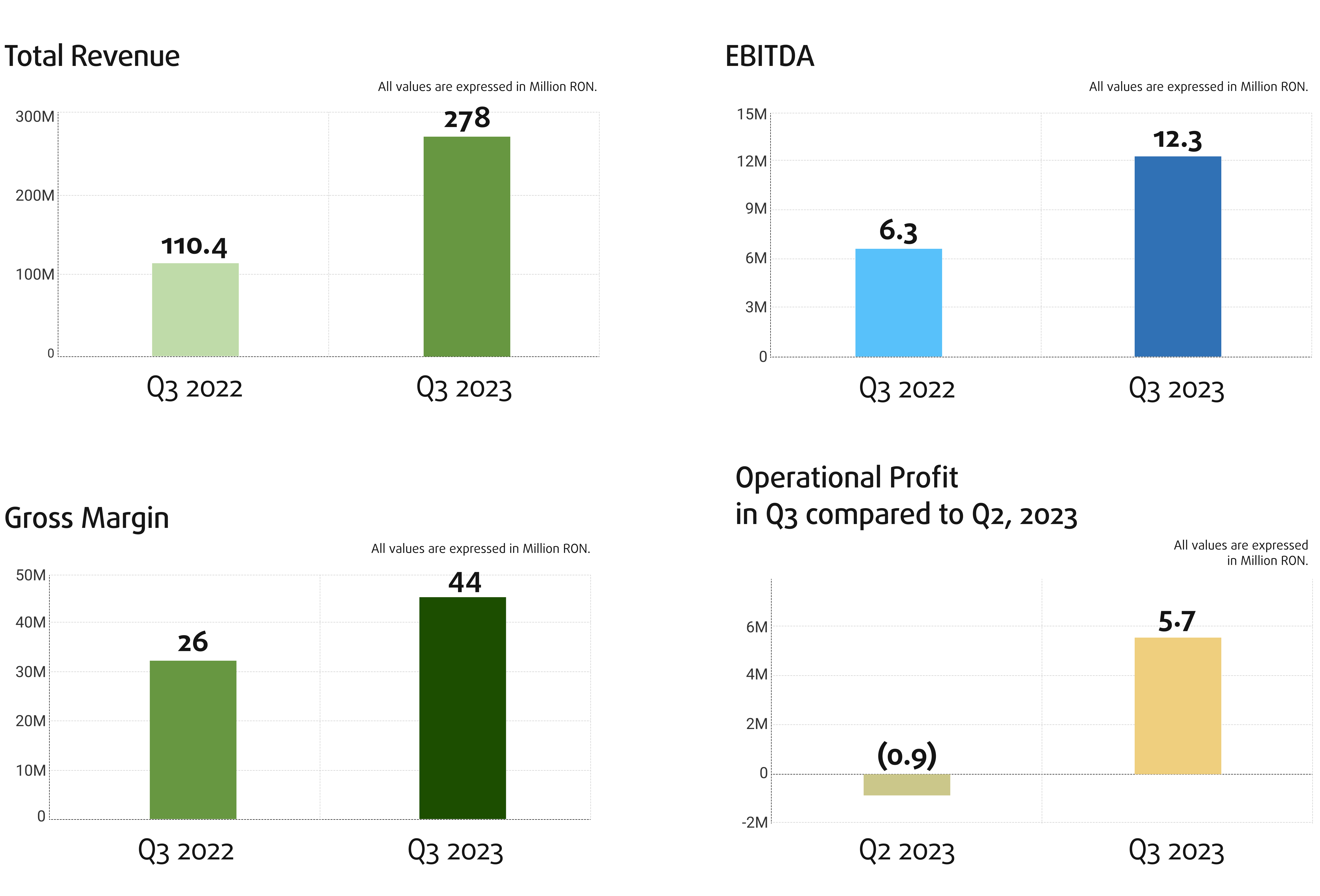

The financial figures for Bittnet Group at 9 months look as follows: the operational profit returned to positive territory to RON 5.7 million (compared to a loss of nearly 1 million ron in first half of 2023). Total revenue reached to RON 278 million with a gross margin of RON 44 million and EBITDA 12.3 million.

The non-operational result (one-off and financial) shows a loss of RON 7.8 million vs RON 9.2 million last year. Thus, the gross profit at September 2023 is a loss of RON 2 million vs a loss of RON 4.3 million in September 2022.

The results we have achieved are not entirely satisfying, but they are a reflection of our constant efforts to improve efficiency. They show a positive trend: the result indicators (EBITDA, Operational Profit) are more than double compared to previous period, which gives us confidence that we can finish this year with a significantly higher profitability than last year.

From the existing pipeline as we recorded at end of June (RON 185 million) in Q3 we already delivered projects of over RON 130 million and we continued to build new pipeline both for the end of this year and for 2024. Thus, for Q4 , the projects that we have under implementation is over RON 100 million in revenue, with a gross margin of RON 20 million and EBITDA of RON 9 million.

The results of the 4 business pillars (Education, Cloud & Infrastructure, Cybersecurity, Platforms & Software) show different development, each with different opportunities and challenges, leading to different measures that we have applied and continue in each company’s case.

In these 9 months Cloud & Infrastructure pillar has shown the best evolution, with revenue growth being easily obtained – more than triple compared to September 2022, and the operational profit being four times higher – nearly RON 10 million. On the other hand, Education pillar was the most affected by the challenging of economic environment: a one-third reduction in revenue and gross margins led to an operational loss of RON -4.8 million.

The Cybersecurity pillar has shown very good progress, recording revenues and operational profits comparable to previous year (RON 12 million in revenue and RON 2 million in operational profit), with significant business transformation intended to generate recurring revenues with greater added value. However, these transformations ‘shift’ a part of the current year’s revenues into the future.

Regarding Platforms and Software pillar, the developments of the two companies differ: while Nenos was affected, like the entire software developers’ market (a 25% decrease in turnover, placing the company at an operational loss at 9 months), Elian has seen a 50% increase in turnover, enabling it to record the same profit as the previous year.

The year 2023 is a tough year in business – major technology companies in the USA have drastically reduced teams and invested budgets, something that ‘cascades’ across the entire global IT service economy, including in Romania. The Romanian economic environment is additionally affected by numerous events causing uncertainty and difficulties. In this unfavourable environment, it might not have been the best idea to aim for increased efficiency and profitability to consolidate our business at this scale.

In this context, perhaps it was not the most inspired choice to aim for profitability at this scale of business. As a positive thing sales efficiency increased significantly, each 1 ron invested in sales and marketing activities bringing almost 21 ron of sales (as opposed to 12 ron in the previous period) and administrative expenses decreased by 20% as a percentage of revenues. In monetary terms this generated a doubling of EBITDA.

Other indicators we measure, providing hope for the end of 2023: cash flow and inventory. In the first 9 months, we generated a cash flow from operations similar to the comparable period in 2022 (7 million RON), while bond issuance and capital increase allowed us to grow threefold the amounts invested in asset acquisitions and M&A (RON 9 million in 2022 / RON 27 million in 2023). We repaid RON 24.4 million in loans (bank and bonds) and ended September with RON 30 million in cash (10 million more than September 2022).

Inventories have returned to a value in line with historical approaches – 7.3 million RON, representing 5% of current assets – and trade payables are covered to the extent of 1.07 times by trade receivables, once again in line with historical values.

We made it clear that we are not abandoning the desire to grow, but subordinated to this idea: the goal of becoming more profitable, with a level of operational profitability appropriate for our industry.

We are very attentive to the significant changes taking place in the world of technology at the moment, with a particular focus on the field of Artificial Intelligence (AI) which this year has surpassed several milestones. We are already exploring these innovations and actively integrating them into our internal processes. We have also expanded strategic partnerships, such as with Microsoft or Cisco, to make the most of the potential of AI in all aspects of our business.

We are optimistic about the progress made so far and have a strong financial situation that allows us to continue on the path of increasing profitability.

As usual, we encourage you to send us feedback about this report, the company’s evolution or future plans. Investors’ feedback is always welcome. You can always contact us at investors@bittnet.ro

Mihai Logofătu,

Founder & CEO Bittnet Group