In addition to the two lines of business, the company also records activities related to the coordination of the group of companies, securing funding through stock market facilities, and certain expenses estimated according to IFRS standards (adjustment which we have also explained in previous reports as non-cash, and which we believe should not be included in the statement of comprehensive income), as well as income or expenses related to “mark to market” investments (companies in which we do not hold 20% of the voting rights).

Thus, during the first 9 months of this year:

- IFRS adjustments related to SOP decreased to RON 734K (compared to 1.2 million last year)

- Interest expenses (bank and bonds) decreased to RON 2.47 million compared to RON 2.74 million in 2020

- We record income from exchange rate differences of RON 57K compared to a loss of RON 200K in 2020

- The value of “mark to market” investments increased by RON 7 million, while last year it was zero. This figure contains in particular the investment in Softbinator, together with Safetech and Arctic Stream.

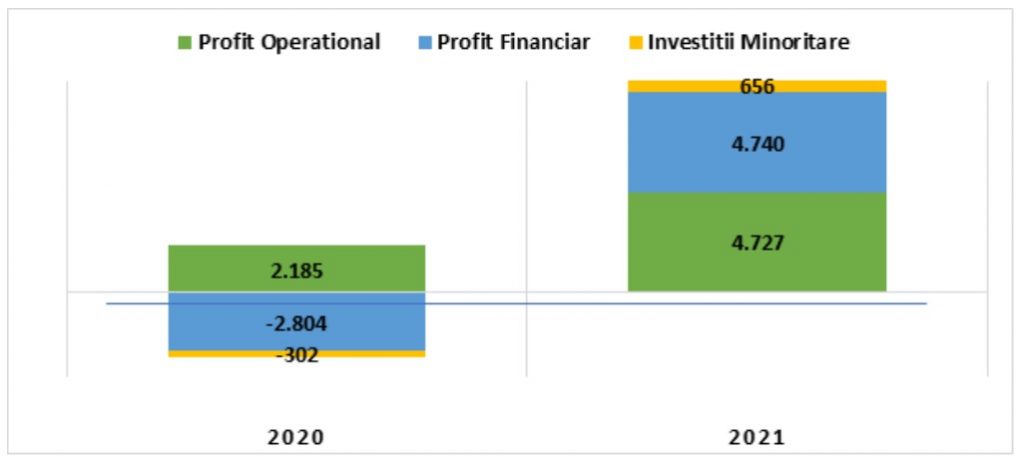

In total, the financial result is therefore a profit of RON 4.7 million in the period under review, compared to a loss of 2.8 million last year. The value of RON 655K – our part of the profit is added to this amount from the profit of the companies in which we have minority interests, but more than 20%. Last year this item indicated a loss of RON 300K.

The combination of these elements generates a gross profit of RON 10.8 million, versus a loss of RON 910K last year – i.e. an increase of more than 12 times in profitability and a consolidated net profit of RON 9,75 million.