We stated in the course of 2020 that we will resume M&A activities and there can be no better time to accelerate the group’s expansion than now.

In this regard, in recent months we have attracted a team of M&A consultants and developed a framework to identify and attract local companies that share our principles and culture of doing business, and that envision the future of industry development in a manner similar to ours.

The first concrete results are already visible, so that, for the General Meeting of Shareholders on November 26, we have put forward for vote the first investment projects that we aim for this year:

- The almost complete acquisition of Equatorial Gaming shares that we do not currently own so as to reach a proportion of 99% of the company, in order to fully integrate operations in the area of Bittnet Training, knowing already that the model is correct and that the team shares our values; Read more HERE.

- Entering the shareholding of the educational services company “The eLearning Company” – which will instantly expand the product portfolio with trainings in eLearning format but also that of clients, to whom we can propose more complex solutions, based on the UXI platform and our “core“ trainings; Read more HERE.

- Entering the shareholding of the company “Softbinator” – a Romanian software development company that has had in recent years an annualized growth even higher than that of Bittnet. This important area of the IT&C service landscape has so far been missing from our portfolio, and we believe we have a good chance to get this journey off to a good start; Read more HERE.

- Investment in the company IT Prepared, which develops an “uber-alike platform for IT support”. Read more HERE.

These projects fall within our strategy on M&A: “bolt-on” acquisitions that help consolidate the Group’s activity in the field of Education (Equatorial and The eLearning Company) but also of Technology (Softbinator and IT Prepared), thus contributing to the development of the portfolio at a time when the need for digital skills is growing for organizations that want to survive in the medium term.

International studies show an increase in the demand for soft skills courses for IT specialists and especially for team IT leaders. Equatorial experience in terms of content and design capabilities creates opportunity to complete the offer that Bittnet Training, the leader in the IT training market, can make to traditional customers.

We will reposition Equatorial as a provider of “soft skills” for the Romanian IT industry. At the moment, this brand space is not occupied and we will be able to generate additional income that until now have not been accessed neither by Bittnet Training because we did not have a product, nor by Equatorial because we did not have access to this market.

The investment will be complemented very well with The eLearning Company products: the electronic softskills courses, as well as the ‘library’ type consumer platform and micro-learning modules, which, in turn, will complement very well with the UXI platform.

Moving our attention to the Technology Division, especially to the investment in Softbinator, about which the local press wrote that it could be the transaction of the year in Romanian IT, it completes our portfolio of products and services in an area that does not exist at all within the group.

Most digital transformation projects involve a mix of technologies, products and powered by cloud, so in the new formula, the ability to deliver more complex projects for our customers increases exponentially. Softbinator Technologies has experience in attracting international clients, Bittnet has an impressive list of local clients and the two companies can mix the two expertise to expand a common portfolio of clients. Bittnet Group delivers infrastructure and integration solutions, Softbinator can complement with custom development solutions over integration. An efficient mix of integration and development can be created, through this synergy given by the complete delivery of services. Softbinator Technologies already had a fruitful collaboration with Bittnet Training, delivering custom trainings together in the last 2 years, on topics of great interest such as DevOps and Agile.

The investment in IT Prepared or the acquisition of their ‘uber-alike platform for IT support’ would allow Dendrio to ‘steal the start’ in offering this type of services to the group’s clients, on a much larger scale than ever before.

This expansion and entry into the shareholding of several IT companies is part of our growth strategy, which we have already tested and refined in recent years. Along with an organic growth of 40-50% per year, the continuous expansion of the portfolio of products, services and customers can be done very well through M&A processes.

According to the principles of efficient capital allocation, we negotiated with each of the companies in which we will enter the option to pay as much as possible for their shares with Bittnet shares, through an equity swap.

As long as the valuation of our company will be made at multiples higher than those at which the investments are made, the payment of purchases with BNET shares will automatically generate the increase of the value of our company.

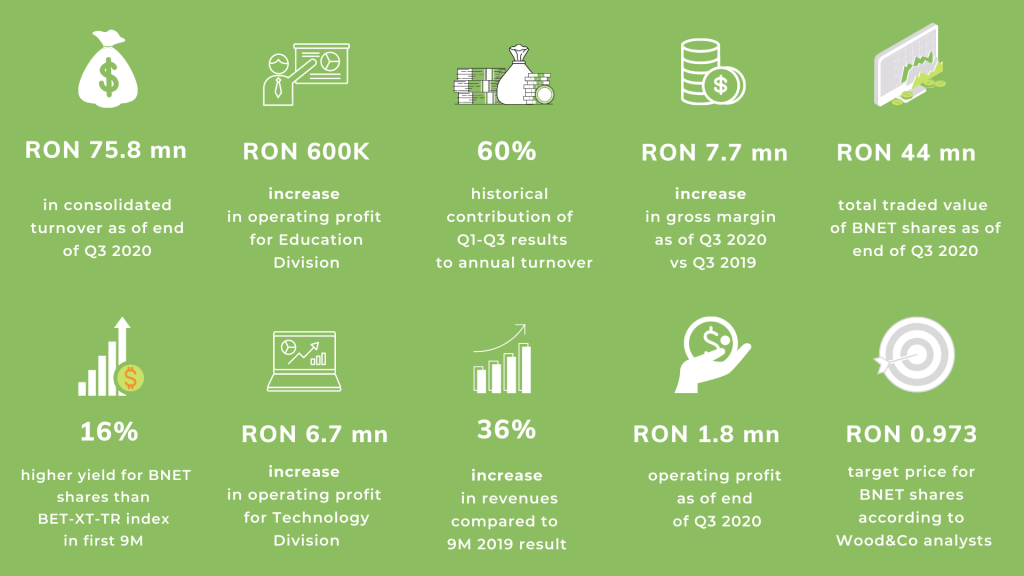

After the end of the third quarter, but before sending this letter, the first analysis report was published by analysts from Wood&Co – one of the most prestigious investment banks focusing on the CEE area. Wood analysts recommend BUY for Bittnet shares, given a target price of RON 0.973, which represents at the time of publication of the Wood&Co report a potential increase in the share price of +49.6% – about RON 1. The most important aspect highlighted by this analysis report is the confirmation of the models adopted by Bittnet’s management, the alignment with global trends and the attention paid to the evolution in the medium and long term, as appropriate for capital market investments.

The full report is available HERE. However, we mention that this target price as well as the purchase recommendation is based on a financial model in which an average growth of only 20% per year of our business was assumed, which represents a rate well below that recorded so far, of ±70% annual!