Letter from the CEO

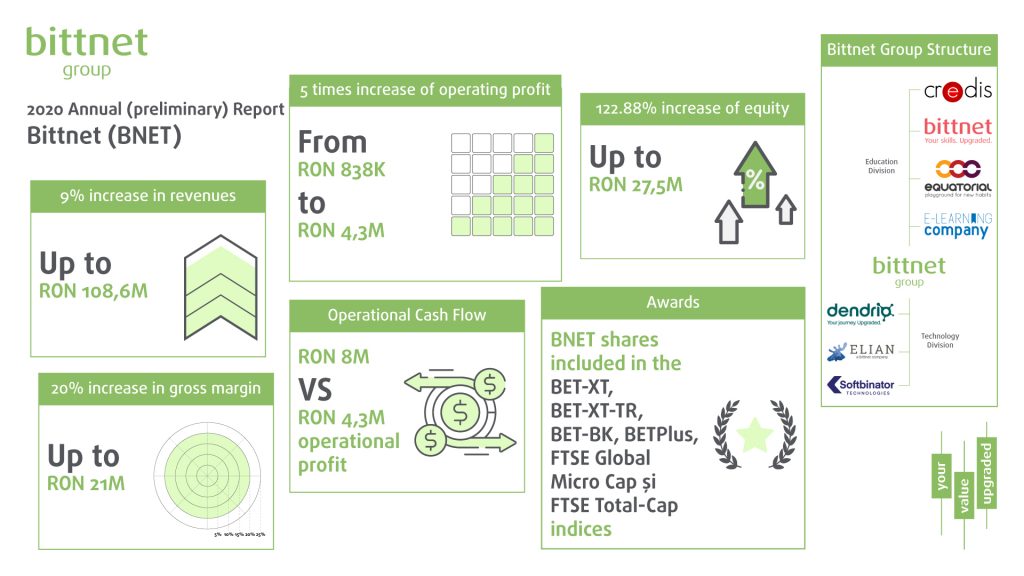

2020 was a challenging year for companies around the world. Despite this, we are grateful that for fiscal year 2020 we keep our tradition and say, again, that we had the best year in history, achieving a solid financial performance marked by an increase of about 9% in consolidated revenues to RON 108.6 million, a 20% increase in the gross margin generated and, an increase of over 5 times the operating profit compared to 2019 – from RON 838k to RON 4.31 million. The consolidated net result of the Group increased by almost RON 2.7 million, becoming profitable again. 2019 is therefore the only year in history when this indicator had a negative value.

2020 was a challenging year for companies around the world. Despite this, we are grateful that for fiscal year 2020 we keep our tradition and say, again, that we had the best year in history, achieving a solid financial performance marked by an increase of about 9% in consolidated revenues to RON 108.6 million, a 20% increase in the gross margin generated and, an increase of over 5 times the operating profit compared to 2019 – from RON 838k to RON 4.31 million. The consolidated net result of the Group increased by almost RON 2.7 million, becoming profitable again. 2019 is therefore the only year in history when this indicator had a negative value.

In a year in which most of the companies were either severely affected, partially or totally shutting down their activity, or having their turnover decrease by 10-20%, our Group achieved an operating cash flow of over RON 8 million, as in 2019, which, combined with access to the capital market, allowed us to apply Warren Buffet’s suggestion to be brave when others are afraid. Therefore, in 2020 we made new investments in businesses, worth over RON 10 million, and we already start to feel the positive effects of these decisions in 2021. In addition, we also strengthened our financial position. In 2020, we managed to consolidate our “financial fortress” ending the year with almost RON 25 million in cash, compared to 21 million last year.

2020 marks the end of a decade in which the company has grown over 50 times, becoming the market leader in most segments in which it operates, but also the first IT company listed at Bucharest Stock Exchange. Starting with 2020, our shares are traded on the Main Market and we are part of relevant indices such as BET-XT. This week, FTSE Russel announced the inclusion of BNET shares in two global ‘micro-cap’ stock indices.

As Bill Gates said, „most people overestimate what they can do in a year but underestimate what they can do in 10 years”. We thus look with confidence to the next period that will be marked by the transition to an increasingly digital economy, in which the winners will be the states and organizations that will succeed in reinventing themselves digitally as quickly and as much as possible.

In many ways, last year was a test of maturity for our team, for management in general, for our plans to become a regional digital player for medium-sized entrepreneurial companies in the CEE. Looking back over the last 10 years, we believe that we have had an extraordinary journey and we would like to thank those who have been with us all this time – colleagues, investors, business partners and last but not least customers.

Just as bridges are subjected to extreme endurance tests before inauguration, so has 2020 been – a sum of endurance tests for Bittnet Group. I am happy to tell you that we have passed these tests well and our Group is more financially and operationally ready for a new cycle of accelerated growth, adapted to the new business reality, to the new challenges and local and international market opportunities. We have a mature and experienced top management team that has overcame the resilience test of recent years.

From an operational point of view, the Group works better in the new dimensions and we will always continue to improve all aspects where we can make a difference, and as proof stands the fact that in total, we generated business of almost RON 140 million during this difficult year. A part of these projects will be delivered only in 2021, partly due to delivery delays generated by lockdowns on the international supply chain in case of deliveries of hardware equipment, and partly due to the December elections in our country, which generated delays in various procurement procedures.

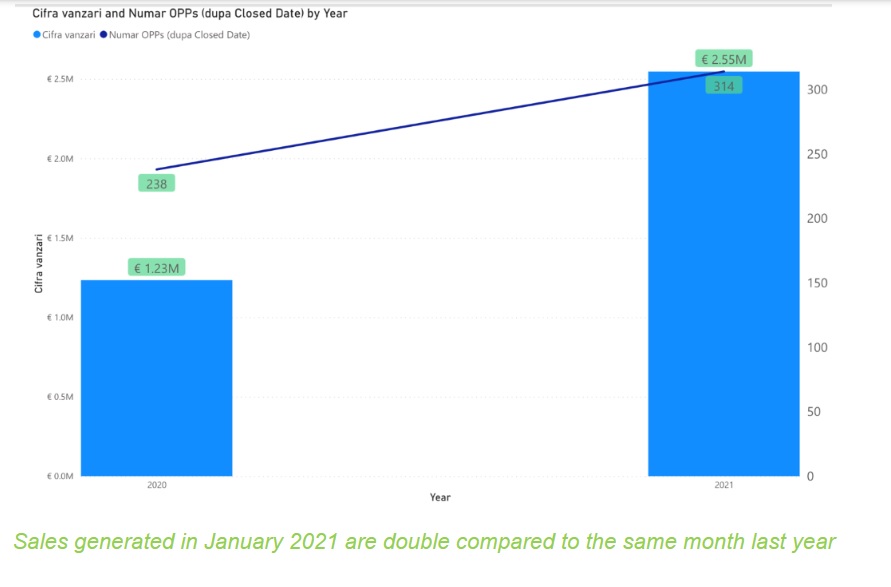

On the other hand, the fact that some of these projects could not be delivered during 2020 only strengthens our confidence in the future – these revenues will be added to those to be generated in 2021. As showed in the following chart, the year started strong, sales generated in January 2021 being double compared to last year, which motivates us to enter with great ambitions this year.

2020 was a

2020 was a