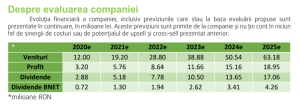

The most significant balance sheet position we have related to listed companies is our holding of Sofbinator Technologies (CODE) shares. The history of this investment starts in 2020, when we acquired 25% of a software development company – an IT area that was missing from our portfolio of services, having a track record and growth ambitions – we reproduce the facsimile of the investment case:

For this holding we paid the amount of RON 8 million, of which RON 4.5 million in BNET shares and RON 4 million in cash. During 2021, Daniel Ilinca, founder and CEO of Softbinator Technologies expressed his intention to have direct access to capital market instruments by listing the company separately, which is also in line with our ideas for further development. During 2021, related to the listing process, we received historical dividends and sold part of our holding, recovering RON 2.8 million of the RON 4 million in cash allocated 9 months earlier. In terms of cash, we have a total exposure of RON 1.2 million.

In terms of holding cost, any individual investor with the same investment history as us would have a holding cost of RON 1.2 million and a market value of RON 12.5 million in the broker statement. Considering the continuous evolution of Softbinator Technologies’ business, beyond previous expectations, we consider that this investment is more correctly seen as “a very successful one” than “one that generated a loss of RON 3 million in 2022”. Small downside, infinite upside.

In the case of Chromosome Dynamics, we invested RON 150 thousand in the company in August 2021 and sold shares worth almost RON 210 thousand a year later – a 45% return on investment. In the case of Safetech, we allocated in October 2020 almost RON 300 thousand in the company and sold between January 2021 and March 2022 the entire holding,obtaining over RON 3 million – a return of 1000%. Small downside, infinite upside.

If we ignore returns, IRR, multipliers, and look simplistically at “cash on cash”, we have allocated in these 4 investments (CODE, CHRD, SAFE, AST) a total amount of RON 6.25 million, and we have recovered a total of RON 6.1 million Thus, we have a cash exposure of RON 140 thousand, which is worth on the stock exchange about RON 14 million. Although in our opinion both CODE and AST shares are worth significantly more, IFRS provisions require us to publish a revaluation loss IN THE PROFIT ACCOUNT of about RON 3 million, while any investor would like to have a liquid asset amounting to RON 14 million for which he paid 0.14 million!

We believe that successful investment activity can significantly enhance both the group’s growth plan and, more importantly, generate a state of anti-fragility. Accounting regulations strictly prescribe how investment results are accounted for, with the potential to sometimes generate significant “on paper” fluctuations in these values, in a very different way than how investors naturally expect this activity to be accounted for. But this should not be a reason to determine us to give up on making good investments!

We will continue to invest heavily in other companies, according to the M&A programmatic strategy, which will generate various fluctuations in financial profits in the future. These results never come linearly, and are not intended to replace operational activity – we are not an investment fund. It is instead the result of how we build every partnership, every investment, and how we position ourselves – small downside, infinite upside.