Under the leadership of Cristian Herghelegiu (CEO Cloud and Infrastructure), this business pillar contains 4 companies, providing complex IT solutions to corporate, large corporate, enterprise and public sector clients across the country.

The projects developed by the companies in this technology cluster cover a broad spectrum of solutions, starting from physical communications infrastructure, perimeter security, video systems, digital signage systems and computing and printing systems and continuing with the design and implementation of complex data centre/hybrid or cloud IT architectures, enterprise networking, cyber security platforms and the implementation of related software platforms, including collaboration platforms (modern workplace).

The services provided are both project-based and managed services, with managed services being delivered mainly to clients in mature markets, Europe and the United States. The companies that are part of this pillar are:

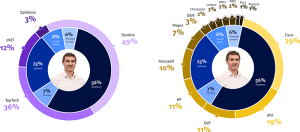

- Dendrio Solutions SRL (CUI 11973883 ), 88% owned by Bittnet and managed by Iulian Zamfir, is the only multi-cloud integrator in Romania, partner certified to the highest standards by Cisco, Microsoft, Google, Amazon Web S0ervices, but also many other vendors, being the company that brings together IT&C integration activities coming from Bittnet, Gecad Net and Crescendo.

- TopTech (Tax registration number CUI 2114184) 86% owned by Bittnet, and managed by Dragos Groza, is a company with a 30-year experience, integrating IT infrastructures (communications, data processing, physical security systems) from vendors such as Dell, HP, Xerox or Microsoft, with a regional presence, 6 branches in Transylvania and Banat and a team of over 86 specialists.

- 2Net Computer SRL (Tax registration number CUI 8586712) , owned entirely by Bittnet and managed by Mr. George Tomescu – the founder of the company who also stayed with us during the transition process – it is a company specialized in the sale of equipment and the implementation of IT infrastructure solutions with regional presence, having presence in Brasov and Covasna counties (thus contributing to the national presence of the group).

- Optimizor – formerly IT Prepared SRL (Tax registration number 35456175), 50.2% owned by Bittnet and managed by Alexandru Ana, is an entrepreneurial managed services company (“Managed services”) founded in 2016, providing IT support services mainly to the US market. ITPrepared’s client portfolio is primarily based on US companies, but also contains a number of local clients. Managed services represent the outsourcing of responsibility for maintaining and anticipating the need for a range of processes and functions that aim to improve operations and reduce expenses within a company

| Cloud & Infra in 2021 | Cloud & Infra + TT & 2net In 2021 | Cloud & Infra In 2022 | % Total | % Organic | |

| Revenues from contracts with clients | 92,213,685 | 171,740,660 | 210,617,501 | 128% | 23% |

| Cost of sales | -76,842,529 | -142,492,590 | -178,364,049 | 132% | 25% |

| Gross margin | 15,371,156 | 29,248,071 | 32,239,926 | 110% | 10% |

| Sales/distribution costs | -5,377,309 | -5,472,482 | -7,461,198 | 39% | 36% |

| Administrative expenses | -5,431,697 | -16,115,551 | -24,069,545 | 343% | 49% |

| of which depreciation | -1,020,862 | -1,857,637 | -2,311,916 | 126% | 24% |

| One-off result | 1,893,091 | 1,893,091 | -1,343,341 | -171% | -171% |

| Operating profit (without one-offs) | 4,945,313 | 8,598,177 | 4,425,081 | -11% | -49% |

| SOP expense | 0 | 0 | 0 | ||

| Financial result | -1,929,832 | -2,181,135 | -1,741,733 | -10% | -20% |

| Of which mark to market revaluations | 0 | 0 | 0 | 0% | 0% |

| Gross profit | 4,908,573 | 8,310,134 | 1,340,007 | -73% | -84% |

| Income tax | -728,661 | -1,257,867 | -238,355 | -67% | -81% |

| Net profit | 4,179,911 | 7,052,267 | 1,101,652 | -74% | -84% |

This business segment recorded in 2022 solid results in the revenue area but a negative impact on the whole group in terms of profitability: even though revenue grew organically by 23% (and almost 130% in total), gross margin grew only 10% organically, and 110% in total – thus showing that the problem is generated by Dendrio. The additional gross margin generated was not sufficient to cover the increased fixed costs, so the total operating profit decreased by 3%, while the business more than doubled. The additional gross margin generated was not sufficient to cover the increased fixed costs, so the total operating profit decreased by 3%, while the business more than doubled. At the operating profit level, even though TopTech and 2Net also recorded decreases (somewhat normal in that inflationary pressure on costs unfortunately overlapped with the M&A process), the main part of the decrease is generated by Dendrio, for the following reasons:

- Expanding the team too quickly to support the next level of business (three teams have been established in 2022: Project Management Office, Sales Development Representatives and Customer Success); we expect the structure created this year to allow the company to participate in complex projects required by the National Recovery and Resilience Plan;

- The time allocated by colleagues in these teams is reflected in the form of costs only in the Dendrio budget but their efforts have contributed to a certain extent to the results of the other companies, which will be corrected during 2023.

- Accelerated increase in human resource costs – we compete with global companies for access to specialists – competition accentuated by the opening of international markets;

- Disruptions in the global supply chain have led (among many other negative consequences) to increased unpredictability of deliveries and consequently sub-optimal allocation of human resources.

Thus, the focus both in H2 2022 but especially for 2023 and beyond will be on counteracting these negative effects. We have already made the following changes:

- We succeeded to convince a new colleague – Iulian Zamfir – to join the management team in the position of Director of Operations – thus aiming to increase the operational efficiency of the company;

- We have introduced separate P&L based measurements for each function of the company; in this way pre-sales, project management or delivery teams become profit generating and will calibrate their activity accordingly;

- We have launched an initiative to recalibrate the small and medium customer segment resulting in a reduction in the number of customers per segment, which will continue in 2023; we will focus on customers that can be optimally served by Dendrio, with a minimum 20% gross margin;

- We have set an indirect expenditure target for 2023 close to 2022 expenditure, focusing on increasing the profitability of the business; this translates into a resizing of the delivery team.

- The entire technology division – Dendrio by default – will focus on profitability, with growth targets still important but subject to profitability.

In order not to be left with a totally negative impression, we also list some positive aspects of Dendrio’s evolution in 2022:

- Increase in the IT consulting services component (architecture and technology uptake) in relation to implementation services that are correlated with hardware infrastructure

- Strengthening and integrating processes across the dedicated mid-market team and expanding the Sales Development Representatives team across the technology division.

- Increase the number of recurring service contracts provided on a monthly or annual subscription basis.

In TopTech’s case, the highlights for the 30th year of operation are over 30% revenue growth based on over 23% growth in services, with minimal team growth (7% vs. 2021). For 2023 the company aims to maintain accelerated growth by investing in the development of delivery teams, strengthening the position with our technology partners (Dell, HP, Jabra and many others) and increasing the mix of products and services delivered with group companies.

For 2Net, 2022 meant focusing on strengthening the regional team (across all functional areas), maximising partnerships with technology providers and diversifying the solution portfolio, with a focus on growing the service components. As part of this consolidation program starting in Q4 2022 a new Commercial and Operations Manager joined the management team, Mr. Bogdan Cuciureanu – an executive with over 25 years of experience in the IT&C industry, both in Romania and the United States.

Optimizor’s business model (i.e. “managed services”) combined with the services delivery with a focus on foreign markets (United States), but also on Romanian companies with regional presence in Europe, led to a significant increase in the company’s operations of over 35% of revenue and an increase in the operating margin close to 100%; and thus the operating profit by 50%. Please see below a few noteworthy features:

- Expansion of the international client portfolio while maintaining a small team

- Continuous automation of delivery processes – which is a modus operandi for the Optimizor team;

- The new brand conveys more clearly the company’s mission – to optimise its customers’ IT processes and platforms

- Development of the service portfolio by adding the automation of cyber security processes; although it is still an emerging market, in the global context the demand for such services is growing rapidly

- Launch into operation of a platform designed for small and medium-sized companies; the product will incorporate the expertise acquired by Optimizer in foreign markets and its release for sale will start in 2023