This business pillar, managed by Vladimir Ghita, is made up of 3 companies providing cybersecurity services to corporate, large corporate, enterprise and public sector customers across the country. The companies that are part of the group are:

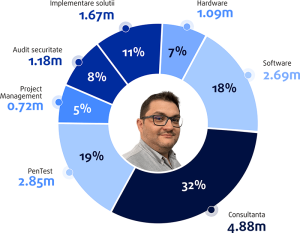

- Global Resolution Experts S.A. (GRX)(Tax registration number 34836770), 60% owned by Bittnet, is a professional services company in the cybersecurity area, offering penetration testing, as well as design, implementation and maintenance of cybersecurity solutions.

- GRX Advisory SRL (Tax registration number 43813325), wholly owned by GRX, offers professional services in the area of cybersecurity, providing penetration testing, as well as design, implementation and maintenance of cybersecurity solutions.

- ISEC Associates SRL (Tax registration number: 23037351), 70% owned by Bittnet, is a company that offers professional services in the cybersecurity area, providing auditing, consulting and penetration testing services in classical and managed services. The company holds numerous certifications (ASF, BNR, CISA, CISM, CEH, CISSP, OSCP, CDPSE, ISO 27701, etc).

Cybersecurity continues to be an area of great interest worldwide, with a great potential for development in the coming period. This is largely due to the increasing volume of threats that companies in all sectors are facing. It is estimated that by 2025 the losses from cybercrime will reach USD 10.5 trillion, while the average cost of a single data breach event is around USD 4.35 million. This context will lead to a global market for cyber security services of around USD 188 billion in 2023.

Fort aims to leverage this favourable context in terms of the services it provides by meeting the unsolved needs of customers to identify, understand and solve potential security gaps. The reduced number of companies and cybersecurity experts has a positive impact on the demand for the company’s services, which has been observed throughout 2022. We expect the trend of increasing demand to continue in 2023, especially given the continued diversification of attacks and the increasing level of sophistication they have in the cyberspace.

Continued investment in 2022 with regard to human resources has enabled the delivery of a considerably higher number of projects, which is reflected in the positive dynamics of turnover. Although the results are significantly better compared to 2021, there is still a need for recruitment, specialisation and retention of cyber security experts. Globally, it is estimated that there are around 3.5 million unfilled positions available to be tackled in 2023. This is also true for Fort, as the growth of the company is more a challenge from the point of view of the delivery team and less in terms of identifying and capitalizing on new sales opportunities. In order to ensure an adequate level in terms of teams, the company intensified in 2022, but mainly in the second semester, the recruitment mechanisms, using in this respect collaborations with 5 providers of “head-hunting” and “talent scouting” services.

| 2021 | 2022 | FY22 vs FY21 | |

| Revenues from contracts with clients | 10,491,822 | 15,048,523 | 43% |

| Cost of sales | -5,375,089 | -9,305,767 | 73% |

| Gross margin | 5,116,733 | 5,742,756 | 12% |

| Sales/distribution costs | -42,588 | -339,971 | 698% |

| Administrative expenses | -1,808,449 | -2,145,012 | 19% |

| of which depreciation | -231,465 | -253,454 | 10% |

| One-off result | 680,030 | -151,175 | -122% |

| Operating profit (without one-offs) | 3,401,379 | 3,979,000 | 17% |

| Financial result | -26,254 | -11,769 | -55% |

| Gross profit | 4,055,155 | 3,816,056 | -6% |

| Net Profit, of which: | 3,918,293 | 3,620,615 | -8% |

The significant expansion of the team, in order to support the business level targeted in 2023, has “loaded” the P&L of 2022 with costs of about RON 685,000. From a business point of view this is an “investment in the future, in the team”, an investment that is expected to pay off from H1 2023. From a profit point of view for 2022, however, this is an expense with no related income.

Another similar element, temporarily masking Fort’s business evolution, is the start of the execution of a project co-financed by European Funds, through which an innovative solution based on artificial intelligence will be delivered. The value of the whole project amounts to RON 7.34 million, of which the European funding amounts to RON 5.74 million. During the fiscal year 2022 we have recorded expenses related to the project and not covered by grant income in the amount of RON 150,000 (in other words a negative impact on profitability of RON 150,000). With the completion of the product financed in this project we expect regular long-term revenues starting from 2024.

Without these investments in the future of the company, the operating profit would have registered a positive development of 41%, identical to the turnover. We believe, however, that the temporary “pain” generated by only 17% growth in operating profit is one that will bring significant value to our shareholders, and to Fort – a company we intend to list during 2023.

This company has no bank loans, consistently generates positive operating cashflow, which is why a substantial share of net profit in 2022 will be distributed as a dividend to Fort shareholders (Bittnet being the main beneficiary).