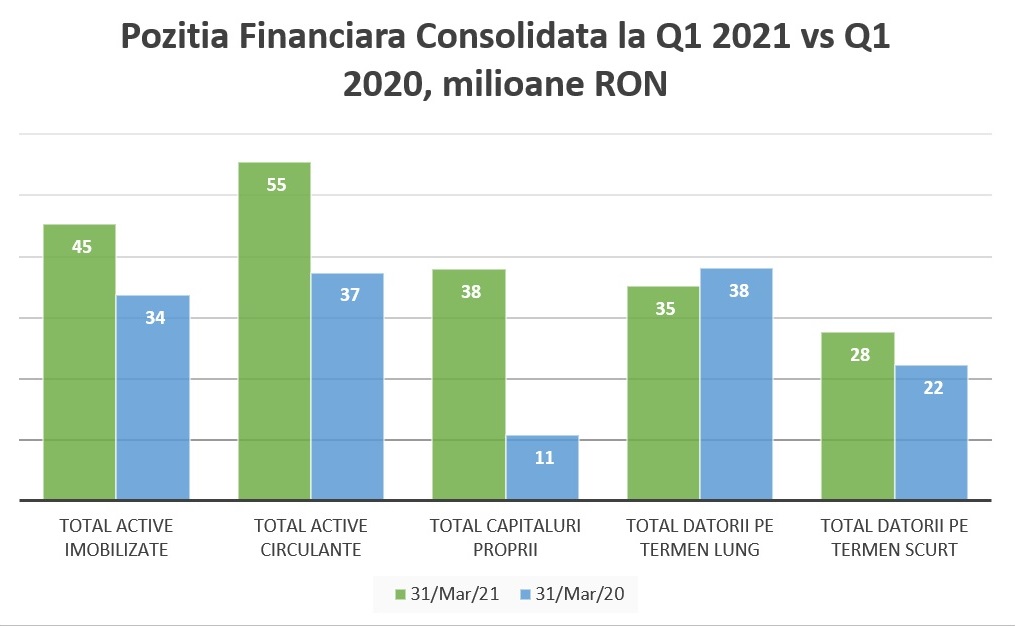

In Q1 2021, fixed assets increased due to the acquisition of Equatorial (assets that were not previously consolidated), and the investment in Softbinator and eLearning Company (9.6 million lei).

Current assets increased due to the cash difference available at the end of the period: 32 million lei on March 31, 2021 versus 13 million lei on March 31, 2020.

The increase in equity is due to the increase in number of corporate operations carried out between March 2020 and March 2021, together with the recording of a positive net result in 2020. This was the only event with an impact on the financial position of the Bittnet Group in Q1 2021.

The decrease in long-term debts in Q1 2021 compared to the same period last year is generated by a lower balance of bank loans (3.8 million in 2021 versus 6.4 million lei in 2020). On the other hand, the increase in short-term debts is generated by the increase in the balance of short-term bank loans, from 1.7 million lei in 2020 to 7.6 million lei in 2021.

After the end of the analyzed period, but before the publication of this quarterly report, our Group repaid in advance the BNET22 bond issue.

| Amounts in lei | Q1 2021 | Q1 2020 | YoY |

| Revenues from customers contracts | 20,203,231 | 20,989,824 | -3.7% |

| Gross margin | 4,012,112 | 5,151,413 | -22.1% |

| Other revenues | 103,757 | 99,133 | 4.7% |

| Sales/distribution costs | -2,057,505 | -1,779,025 | 15.7% |

| Administrative costs | -3,036,242 | -2,683,623 | 13.1% |

| EBIT (Operational Profit) | -977,877 | 787,900 | -224.1% |

| Profit/(loss) investments accounted for using the equity method | 185,773 | -152,332 | 222% |

| Financial income | 1,246,512 | 263,975 | 372.2% |

| Financial expenses | -990,136 | -1,068,595 | 7.3% |

| Gross profit | -535,728 | -169,053 | -216.9% |

| Income tax | 32,110 | -2,040 | 1674% |

| Net profit, of which: | -503,617 | -171,093 | -194.4% |

| Net profit attributable to the parent company | -495,327 | -203,165 | -143.8% |

| Non-controlling interests | -8,290 | 32,072 | -125.8% |

Looking at Q1 2021 alone, the turnover registered a decrease of 800K lei (from almost 21 million lei to 20.2 million), found almost entirely in the generated gross margin. The positive evolution of the indirect expenses within Q1 2021 vs Q1 2020 of approximately 700K lei resulted in the operational profit registering a negative value of 1 million lei. Also in the quarter, the evolution of financial profitability is a positive one, so that at the level of gross profit and net profit, the difference compared to Q1 2020 is an insignificant decrease, below 300K lei.

Analyzing the Revenue and Expenditure Budget for 2021 approved by the shareholders in the Annual GSM of April 2021, the contribution of the Q1 2021 results amounts to 13% of the BVC, in line with the historical share. As an indication, in the company’s history, the results of the first quarter contributed on average 10-15% to the total consolidated revenues generated in one year. Particularly in 2020, the Q1 came to contribute with over 20% amid a wave of events that significantly affected Q4 and thus the total share of Q1 increased. We maintain our budget estimates for 2021.