Letter from the CEO

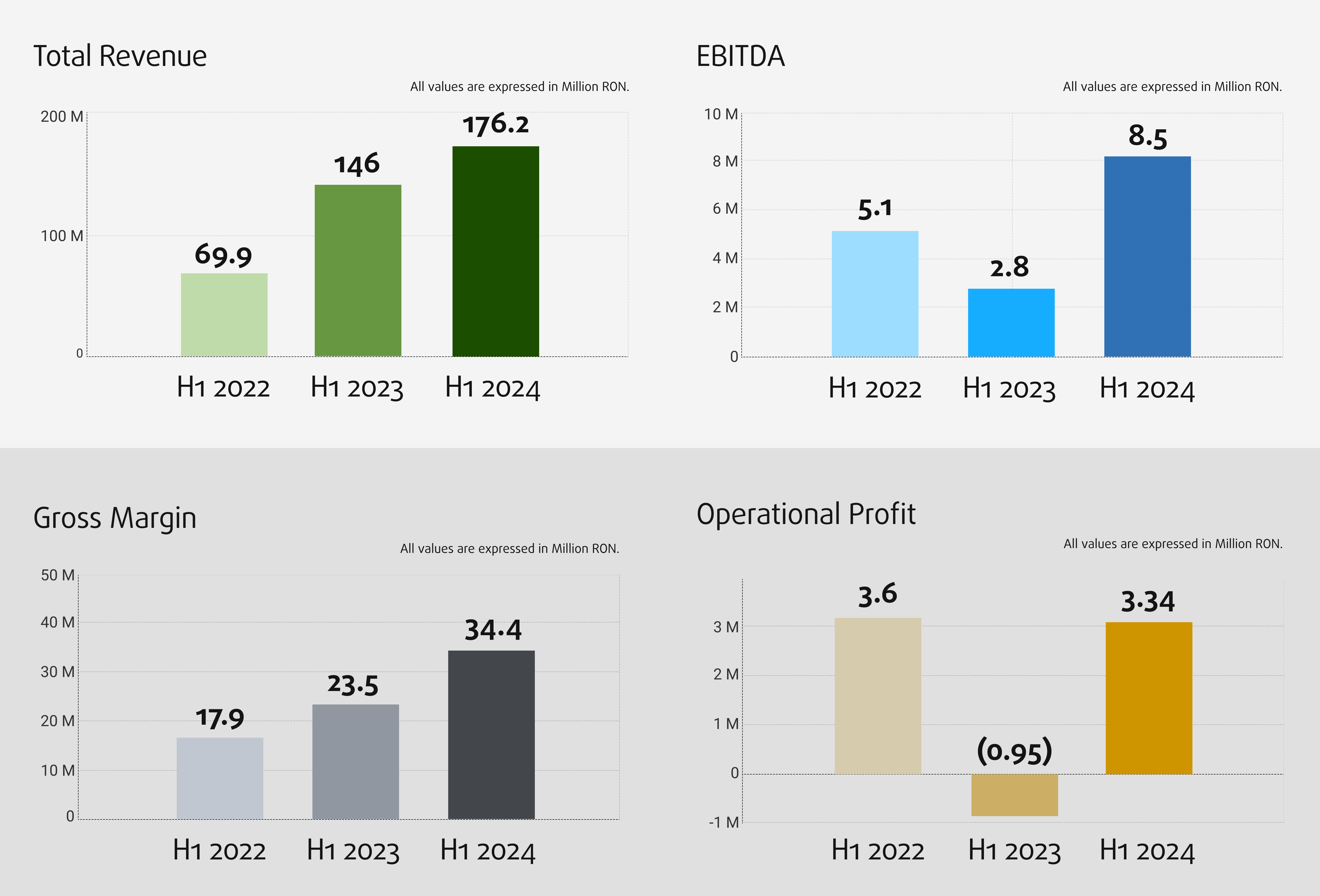

First Semester of 2024 Bittnet achieved revenues of 176 million ron, +20% compared to the same period of last year. The gross margin was 34.4 million ron, +46% compared to S1 2023, and EBITDA increased to 8.5 million ron, +195% evolution compared to the previous year. The operating profit was 3.34 million ron at H1 2024, compared to a loss of almost 1 million ron in H1 2023.

The financial result was negative, -6.4 million ron, which leads to a net loss of -4.2 million ron compared to the loss of -5.4 million ron in the same period last year. The net result is a negative one, mostly determined by revaluations without a direct monetary impact – the reevaluation from mark to market holdings in other listed companies on AeRO Market, but also by the seasonality of activities that are mostly concentrated in the 2nd Semester for our Group’s business.

At the end of H1 2024, consolidated capitals (equity) was 99 million ron and the cash position remains solid, 35.9 million ron.

If we analyze the results also from an annualized perspective – last 12 months ended 30 of June 2024 (TTM), total revenues amounted to 405 million ron (increase from 268 million), gross margin exceeds 77 million ron, up 59% vs. H1 2023, and indirect expenses amount to 64.6 million ron (up from 50.7 million in H1 2023). TTM operating profit stands at 16.4 million ron, +333% compared to the similar period when it recorded the value of 3.8 million ron.

In H1 2024, we started some significant projects, including the modernisation of the IT infrastructure of the national telemedicine system in Romania. We achieve revenues of approximately 60 million ron from the backlog of 260 million ron from Q1. The current backlog of contracts, with estimated delivery date until the end of 2024 currently amounts to 220 million ron. Added to this backlog is a consistent pipeline of projects in various bidding and negotiation phases of 250 million ron.

As promised, in the first half of the year we focused on simplifying the Group structure, thus reducing expenses and we consolidated the pillars of Digital Infrastructure and Business Applications around Dendrio and Elian. In this regard, we submitted two merger projects to integrate 2Net Computer into TopTech, in the Transylvania region, and to absorb Computer Learning Center and Equatorial Training into Equatorial Gaming, thus strengthening the Education pillar. Also, in H1 we obtained the authorization to supply 5G equipment, which allows us to offer new IT solutions to our customers.

Even if it is not an event attributable to the 1st Semester, in August we also launched buyback program of own shares, the first operation of this kind carried out by our group, according to the mandate granted by the shareholders and with a minimal impact on the group’s treasury.

In the previous letter for shareholders (1Q Report), we expressed our confidence acchiving the 2024 budget, allthough the first quarter, historically speaking, contributes with only 15% to total revenues and the 1st Semester, on average, 35-40%. At mid-year, we achieved 44% of our annual budget, at the revenue level, which reconfirms that we are on the good track to achieve our targets by the end of the year.

As always, we encourage you to send us feedback about this report, the progress of the group’s activities or our future plans. You can always contact us at investors@bittnet.ro. Investors’ opinion is always important to us.

Mihai Logofătu,

CEO & Co-founder Bittnet Group