Letter from the CEO

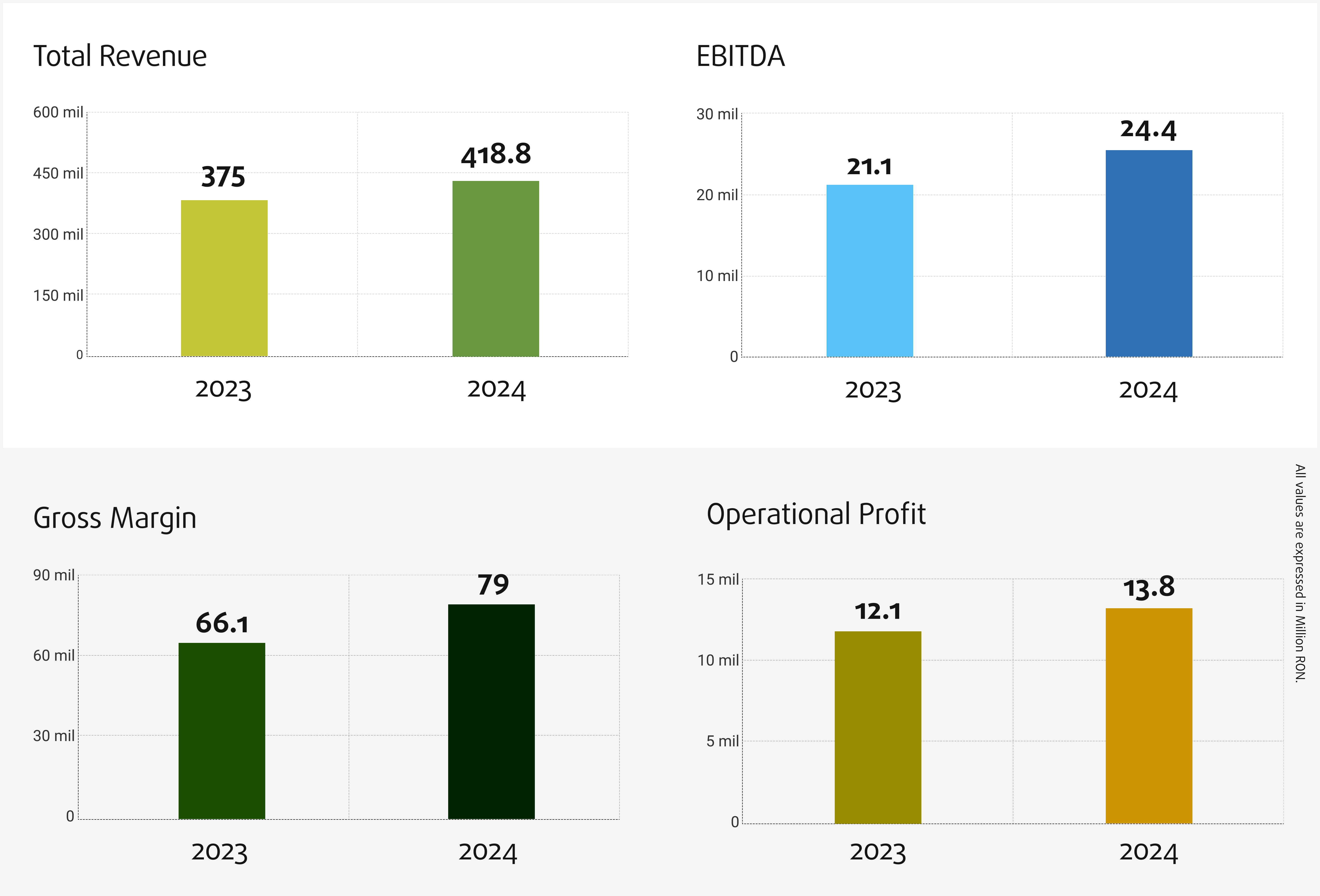

In 2024, the Bittnet Group achieved Consolidated Revenues of 418.8 million ron, an increase of 11.5% compared to the previous year. The Gross Margin rose to 79 million ron, up 20% compared to 2023, while EBITDA reached 24.4 million ron, marking a 15% growth versus the previous year. In 2024, the recorded Operating Profit is 13.8 million ron, up by 14%.

The non-operating (financial) result is a loss of 800 thousand ron, which includes, as in previous years, a mark-to-market adjustment of Bittnet’s holding in Softbinator (BSE:CODE), amounting to -4 million ron. Thus, the consolidated gross result of the Bittnet group, at the end of the year, is 11 million ron, while the net profit is 9.2 million ron.

At the beginning of 2024, we made the promise that we would restructure and simplify the group, which at that time was organized into 4 business pillars (business units), 9 commercial brands and 16 companies – a size achieved following the M&A processes from period 2018-2023. Thanks to the decisions taken in 2024, this year begins for Bittnet Group with a more clear and more efficient structure, composed of 3 business pillars and 5 commercial brands, reflecting a coherent and future-oriented vision.

We also made a promise to focus on profitability, both operational and net profit. This objective guided us towards an ambitious budget, and today we can say that we achieved it at 97% level for budgeted revenues and EBITDA and 184% for net profit.

Thus, we mark the 17th consecutive year of growth, exceeding the 400 million ron threshold for the first time. Moreover, we recorded increases in all essential financial indicators, a clear proof of the solidity and health of our business.

Looking at each business pillar in detail, we see that Digital Infrastructure and Platforms & Business Apps were the performers last year. It was a challenging year, especially in the Education area, as we have also mentioned in the periodic reports throughout the year. However, the current size of the group has given the Education team the necessary space to adjust the strategy for 2025-2027. In a context where the budgets of traditional clients in this sector were largely frozen in 2023 and 2024, this recalibration is essential for us to adapt and continue to grow.

Our vision remains clear: we want Dendrio (in the Digital Infrastructure pillar) to become one of the largest, modern and well-managed IT systems integrators in Romania and, why not, in the region. To achieve this goal, in 2024 we focused on simplifying the operational structure, creating synergies between the companies in the cluster and group, but also diversifying and modernizing the portfolio of solutions and partners.

Every year comes with its challenges, and 2025 is no exception. It began in a tense geopolitical context, with a direct impact on the business environment and financial markets. However, even in a difficult economic climate, we maintain our sustained growth direction over the past 17 years and remain consistent with our principle of continuous growth. For 2025, we propose an expansion-oriented budget – even though we sold the cybersecurity pillar in 2024 – with a consolidated turnover estimated at 446 million ron for 2025, an increase of +11% (excluding one-offs and the sold business pillar). The gross margin is estimated at 83.5 million ron, and the operating profit at 14.7 million ron and net profit of 6.5 million ron. We are convinced that these objectives are achievable and that, by the end of the year, we will confirm once again our ability to generate value in a constantly changing business environment.

Key events in 2024

- We have exceeded, for the first time in Bittnet’s history, the threshold of 400 million ron in consolidated turnover, the 17th year of uninterrupted business growth – of which over 100 million ron represents revenues from IT services – reinforcing what we have always maintained that we are a group of IT companies focused on service delivery. We will continue to pursue those projects in which the provision of services represents a significant component.

- Almost 10 years after the IPO on the AeRO market and 5 years after the transfer to the Main Market, the consolidated turnover is 51 times higher than in the year preceding the listing and 4 times higher than in the year preceding the transfer to Main Market.

- The gross margin generated reached 79 million ron – over 80% of the entire consolidated turnover of 2019, and the operating profit is higher than the turnover of 2016, while the EBITDA recorded in 2024 has a similar level as the entire turnover of 2017.

- We simplified the group structure by consolidating the companies around Dendrio (in the Digital Infrastructure pillar) and Elian (Platforms/Business Apps & Software Development). Thus, from the second half of 2024, Dendrio Solutions fully took over the subsidiaries Dendrio Innovations and Dendrio Technology, and Elian Solutions fully integrated the company Kepler Management Systems (rebranded: Elian Development Systems), acquired in december 2023.

- We simplified the group structure through two mergers by absorption. In the Education pillar, Computer Learning Center and Equatorial Training were integrated into Equatorial Gaming. In the Digital Infrastructure pillar, 2Net Computer was absorbed by Dendrio Technology (formerly TopTech).

- In the process of consolidating the Digital Infrastructure companies under the Dendrio umbrella, we also rebranded them. Dataware Consulting became Dendrio Innovations, and TopTech changed its name to Dendrio Technology. These changes were formalized at the Trade Register, clearly reflecting our direction of simplification and strategic alignment.

- Successfully achieving the first exit in the history of the Bittnet group: the sale of the cybersecurity pillar – Fort together with the subsidiaries GRX-Advisory and ISEC Associates, a strategic decision to optimize the company portfolio and which was achieved with a net return of almost 100%.

- We have concluded a new corporate bond IPO, ticker BNET28A, worth 6.62 million ron with a fixed interest rate of 9% per annum.

- The operating profit recorded the value of 13.8 million ron, +14% yoy, the same as the entire turnover in 2016, and the net profit, worth 9.2 million ron, is almost double the one budgeted at the beginning of the year. If we were to exclude the effects of one-off events (non-cash and cash), including the FORT sale transaction, we would have achieved a gross profit of 6.5 million ron. In line with the net profit estimated in the 2024 BVC.

- In August, we launched the first BNET share buyback program, through which we purchased 4,000,000 shares by the end of the year. The program continues into 2025, with the goal of canceling the repurchased shares. To date, we have repurchased 5,369,000 shares.

- We are exploring the possibility of introducing a public offer buyback program, subject to FSA approval. This would allow us to acquire a larger volume of shares in a shorter time, complementary to the current program, which respects the daily limits of the spot market.

Investor Day and General Meeting of Shareholders

In 2025, Bittnet celebrates 10 years since the IPO at Bucharest Stock Exchange, opening a new chapter for technology companies in Romania. It has been a journey in which we have not only grown, but also redefined what it means to be a listed company in the IT sector. On April 15th, we will celebrate this moment with our traditional event dedicated to our investors and the capital market, BNET Investor Day, organized at Bittnet’s headquarters in One Cotroceni Park.

Also, the General Meeting of Shareholders is scheduled for April 28th, and, as in previous years, will be organized in partnership with eVote, ensuring electronic access for all those who want to take part in the group’s decisions.

Also, the General Meeting of Shareholders is scheduled for April 28th, and, as in previous years, will be organized in partnership with eVote, ensuring electronic access for all those who want to take part in the group’s decisions.

But, beyond numbers and strategies, Bittnet is about people. I am gratefull to all my 300 colleagues, with whom I have gone through a challenging year, but with solid results. The success of 2024 is, above all, their merit.

If the first 10 years as a public company were about innovation and growth, the next 10 years will be about consolidation and impact. I invite you to review the preliminary financial statements and send us your questions or feedback at the dedicated e-mail address investors@bittnet.ro. Investors’ opinion is always important to us.

Mihai Logofătu,

CEO & Co-founder Bittnet Group