Letter from the CEO

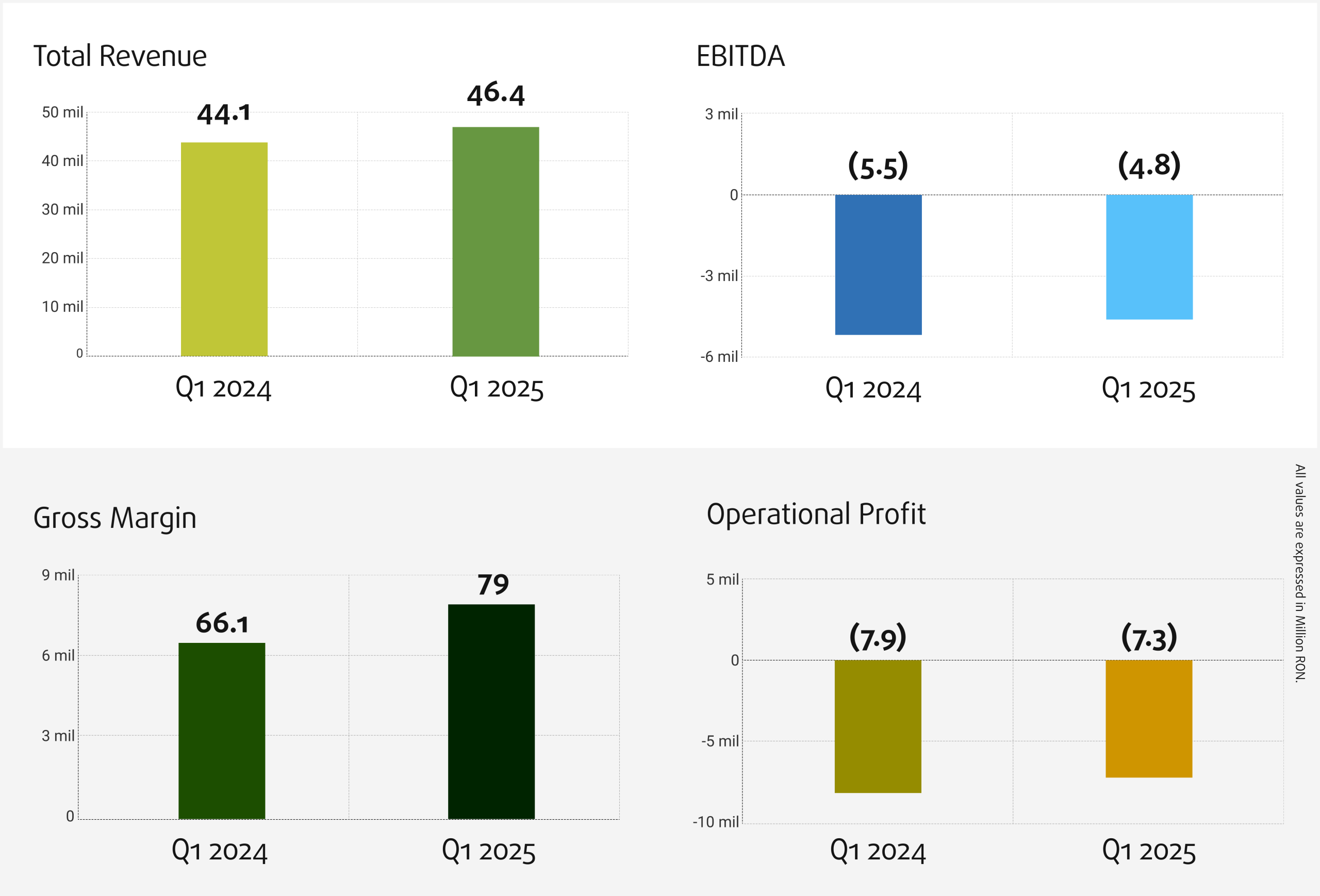

In the first three months of 2025, Bittnet Group recorded consolidated revenues of 46.4 million ron (+12.8% compared to Q1 2024) and a gross margin of 8.1 million ron (+21.7%). Operating profit, the key indicator that we follow with priority, improved slightly compared to the first quarter of last year, from -7.9 million ron on 31.03.2024 to -7.3 million ron on 31.03.2025. As for gross profit and net profit, they remained at levels close to those of the same period of the previous year: -11 million ron and -9.5 million ron for Q1 2025, respectively.

We expect that this year the seasonality will be more pronounced than in the past, with a significant concentration of commercial activity in the second semester. Until the elections in May, many projects – including those with European funding – have been postponed. Therefore, we maintain a balanced approach and a carefully calibrated strategy. Like previous years, Q1 has a low share in total annual revenues – below 15% – which is specific to our industry, especially in the digital infrastructure vertical. Projects are negotiated in the first part of the year, but are implemented and invoiced in the second half.

The backlog of signed contracts with delivery by the end of the year is approximately 265 million ron, with an estimated gross margin of 47 million ron. Added to this is a qualified pipeline of 198 million ron, with a historical conversion rate of 50%.

We continue to focus on projects with IT services delivered by our own team, in all three strategic directions – digital infrastructure, IT education and business platforms & applications –, where the added value and margins are higher.

Looking at the annualized results (TTM/ last 12 months), the group’s revenues increased to 409 million ron, gross margin to 75 million ron (+22%) and operating profit to 13.3 million ron (+189%). This numbers exclude the contribution of former pillar Fort, which left the group at the end of 2024. In 2024, we began a process of simplifying the group structure – from 16 consolidated companies, we reached 8, organized under 4 commercial brands and 3 pillars. In parallel, we continued the portfolio capitalization strategy. The recent transaction regarding the sale of the majority stake in Optimizor – with a return (IRR) brought to BNET shareholders of 40% – reconfirms, like the previous transaction of sale Fort pillar, the undervaluation of the portofolio assets. This will be reflected in the accounting statements related to Q2.

Looking at the annualized results (TTM/ last 12 months), the group’s revenues increased to 409 million ron, gross margin to 75 million ron (+22%) and operating profit to 13.3 million ron (+189%). This numbers exclude the contribution of former pillar Fort, which left the group at the end of 2024. In 2024, we began a process of simplifying the group structure – from 16 consolidated companies, we reached 8, organized under 4 commercial brands and 3 pillars. In parallel, we continued the portfolio capitalization strategy. The recent transaction regarding the sale of the majority stake in Optimizor – with a return (IRR) brought to BNET shareholders of 40% – reconfirms, like the previous transaction of sale Fort pillar, the undervaluation of the portofolio assets. This will be reflected in the accounting statements related to Q2.

In the development area, we are accelerating investments in AI through Nenos and by integrating advanced technologies across all divisions, supported by the partnership with Microsoft.

We remain focused on achieving our 2025 targets in an unstable economic context, but we continue to build for the long term, with caution and determination. As always, we are at your disposal for questions or feedback, at the dedicated e-mail address investors@bittnet.ro.

Mihai Logofătu,

CEO & Co-founder Bittnet Group