A message from the CEO

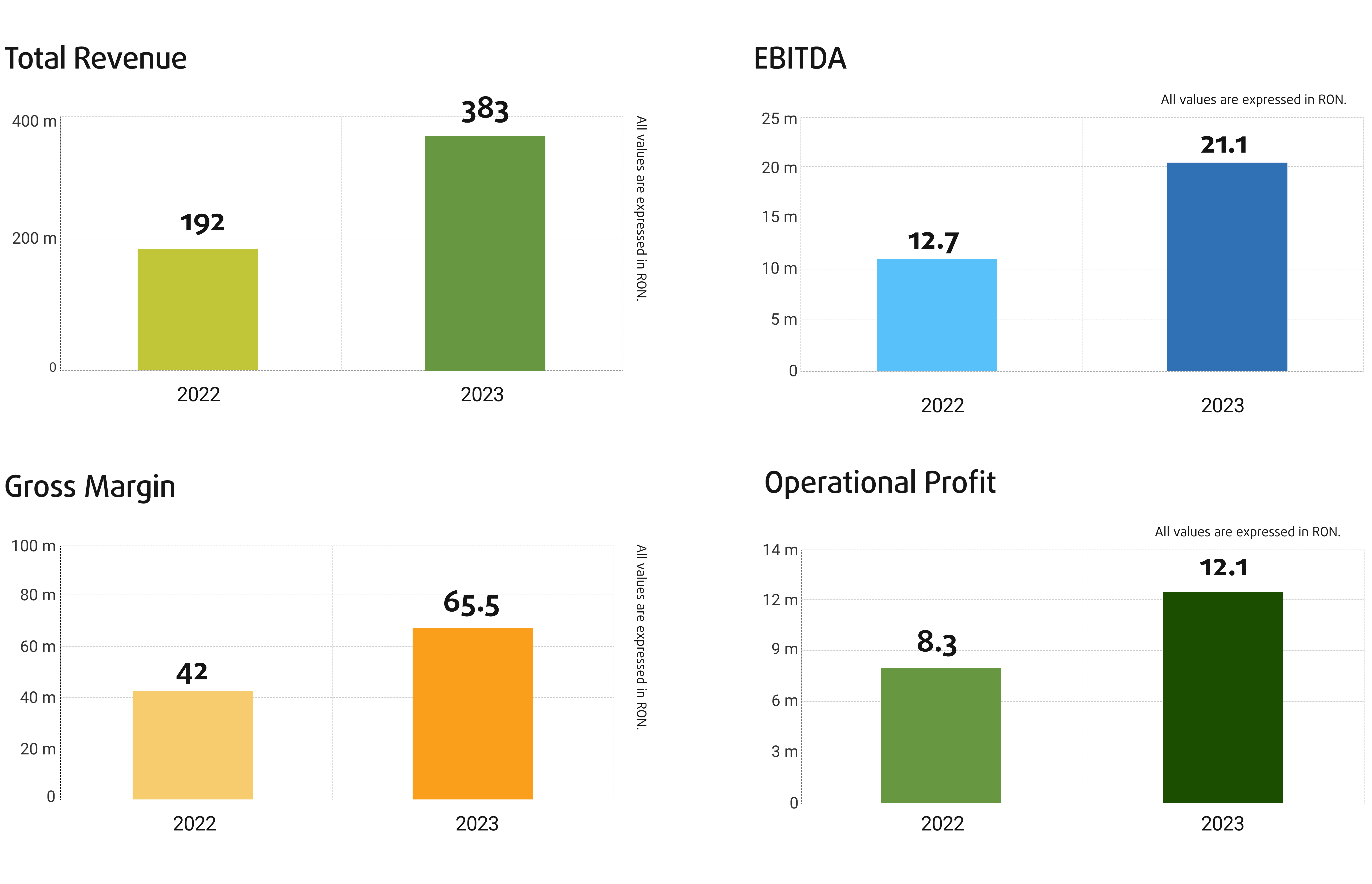

In 2023, the Group’s key indicator, operating profit, increased by 46%, reaching the amount of 12 million lei, and our group’s revenues increased by 100%, reaching 383 million lei. Also, the gross margin increased by 53%, reaching 65.5 million lei, while EBITDA increased by 66%, reaching 21 million lei. The gross profit is positive, amounting to 1.6 million lei.

In a message from February 2023, we emphasized the importance of not underestimating the difficulties we could face in that year and the impact on the performance of our companies. Analyzing each business pillar in detail, we find that the education and software development pillars encountered significant challenges during the year, while other areas exceeded expectations. Moreover, the size of our group has allowed the education team to review and redefine strategy and start the new year with a pipeline of projects for 2024 richer than ever in 16-years history.

It is important to recognize that each year brings new challenges, and these represent opportunities for our group to demonstrate its antifragility. We will not perform in all areas of business every year – we will continue to have good years and bad years in each business pillar. What the current size of our group gives us is the ability to be flexible and own a diversified portfolio of companies to maximize the growth potential of our entire group. For more details on the evolution of the activity and the challenges encountered in each of the group’s pillars, I invite you to consult the next chapter.

In June 2020, when we made the transition to the Main Market of BSE, we presented our strategy for the next 5 years (2020-2024) as accelerating growth through mergers and acquisitions, with the goal of consolidated revenues of 100 million euro by the end of 2024. After the first 4 years of this cycle (11 companies acquired, 3x revenues, 14x increase in operating profit), we remain confident in achieving this goal.

Promises from the beginning of 2023

Also in a message from 2023, while we became more and more confident of reaching the goal of 100 million euro in revenue by the end of 2024, we announced that we would focus on achieving greater profitability from the current size of the business by the following methods:

- Increase the Itservices we provide, in total sales: in 2023, revenues from services were 96 million lei, up 47% compared to the previous year; this value is almost equal to the total revenue of 2019 (the year before the transfer on the Main Market).

- Expansion of the international customer base: in 2023 we delivered projects in 29 countries in the European Union, but also in Great Britain, Singapore, Moldova, Israel and the United States. Revenues from international customers amounted to 24.6 million lei, an effort that will continue in 2024

- Constant control of administrative costs as a percentage of turnover: in 2023, administrative expenses rep-resented 10.7% of turnover, vs. 12.5% in 2022, despite inflationary increases in some costs with a significant share in total (such as rents).

- Increasing revenue through cross-selling between pillars: Each pillar in the group has at least two common clients with another pillar, indicating the existence of a significant number of clients with whom we work together. For now, the revenue generated by these joint customers represents less than 10% of the total revenue for each individual company, but we aim to actively improve this figure.

- Increase in gross margin generated: the annual value of the generated margin of 65.5 million lei represents an increase of over 50% compared to the similar period analyzed previously. Each of these initiatives will continue into 2024, while we also focus on the two sectors that had the weakest year in 2023: Education and Software Development.

About the group structure

The year 2023 was truly a year of transformation for us. We evolved from a simple group of companies to a group organized by activity pillars, with clear roles for each company and the related CEO, with consolidated results on the four main pillars. We took investor feedback into account and began to simplify our structure, reduce the number of brands and integrate them. This simplification initiative will continue into 2024, reflecting our commitment to efficiency and strategic alignment.

2023 in events

- We successfully completed the 5th and largest capital increase in the company’s history, through which Impetum Group became a significant shareholder. We have thus exceeded the threshold of 100 million lei in financing attracted through capital market mechanisms in 8 years (57 million lei in equity and 58 million lei in bonds).

- We repaid three bond issues (BNET23C, BNET23 and BNET23A), bringing the total to 5 issues repaid at maturity or early, while we paid over 12 million lei to 2,000 bondholders during these years.

- For the first time for the Romanian capital market we issued two public offers of corporate bonds (BNET27A and BNET28) which were particularly successful: oversubscription of more than 1.5x, the diversity of investors and a remarkable liquidity after the listing.

- We completed the private placement that will lead to the AeRO Market for FORT in 2024 (the cybersecurity pillar), thus becoming the third company listed in the Bittnet Group, alongside Softbinator.

- Two new companies joined our Group in 2023: Dataware and Kepler, thus strengthening the pillars of Digital Infrastructure and Business Applications.

- Throughout the year, we maintained our commitment to operational profitability by carefully monitoring key indicators such as EBITDA and Operating Profit. This consistent approach allowed us to return to a positive trend in terms of net profitability, albeit to a modest extent. It’s an encouraging sign of our direction, given that we managed to turn a significant negative result mid-year into a positive one, albeit to a small extent, by the end of the year.

- Our financial position continues to strengthen: more than 80% of financial debt is long-term and total financial debt (including those due in 2028) represents 61% of equity, which means we have a ratio of borrowed capital to equity below 1:1. Also, 75% of our year-end cash is equivalent to total financial debt. Additionally, the trailing cash represents more than 40% of the company’s capitalization. For more details, we invite you to consult the “Financial Statement Presentation” chapter.

- We marched on AI (Artificial intelligence) and built a plan to implement AI in our organization, starting from Microsoft solutions, with the aim that in 2024 we will execute the development of solutions in our infrastructure so that every department works at the base with AI. The benefits of this integration in terms of time and cost reduction are obvious.

- We recorded the 16th year of growth in turnover as well as operating cash flow, with significant value. Key business indicators continue to maintain their annual growth trend, ranging from 35% to 75%.

- Even if the GSM took place between the end of the fiscal year and the publication of this document, we believe that the election of a new Board of Directors consisting of independent members, professionals in the field of IT or finance, represents a very important element for the next 4 years.

In the end, I am optimist about the perspectives and I want to share my thoughts of gratitude to our colleagues who have successfully navigated a difficult year. With the return to net profit, we hope to renew the confidence and sympathy of our investors. I invite you to read the presentation of the preliminary annual statements on the following pages, and send us questions or feedback to the e-mail address investors@bittnet.ro.

Mihai Logofătu,

CEO & Co-Founder Bittnet Group