Letter from the CEO

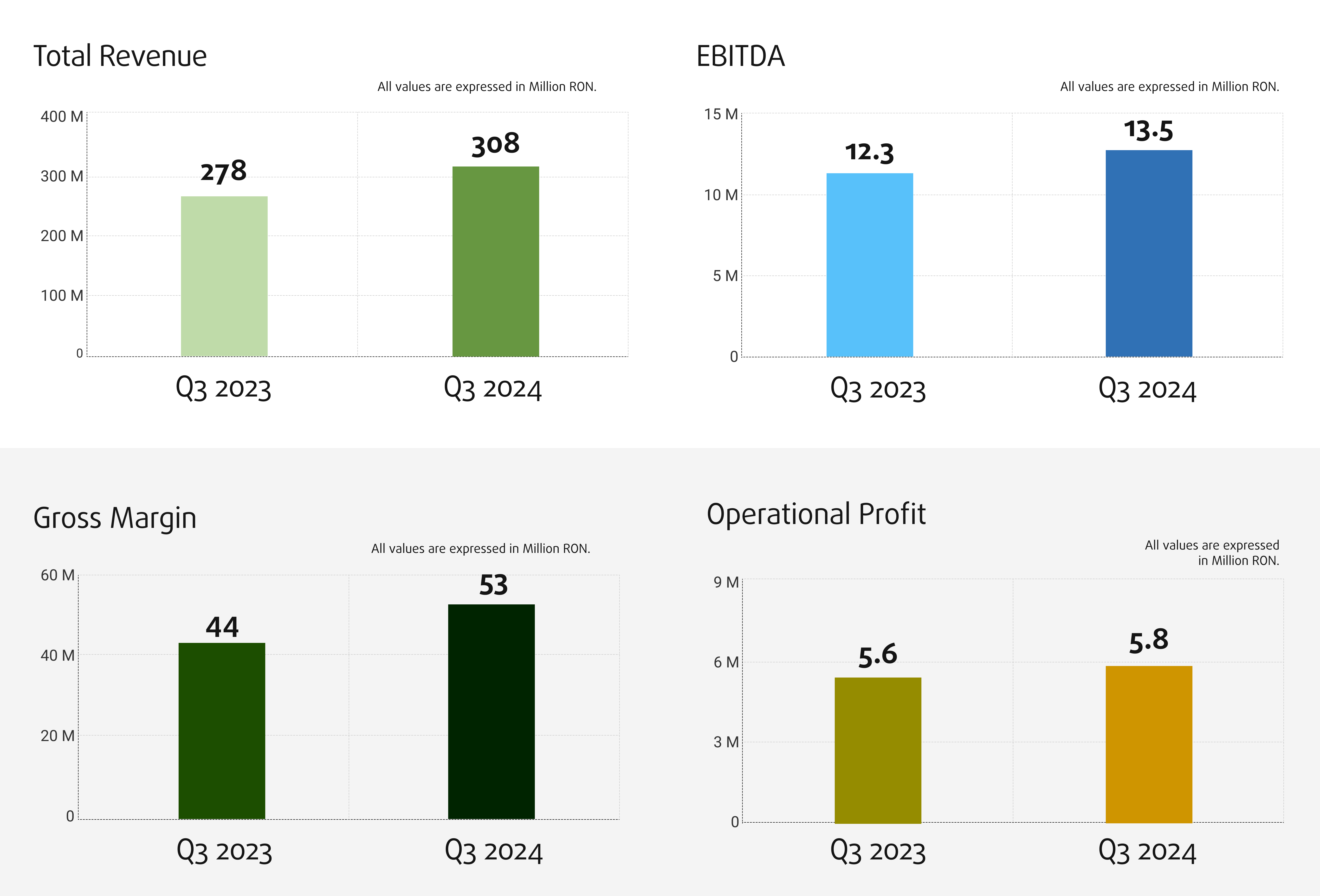

For the first 9 months, Bittnet achieved consolidated revenues of 308 million ron, up 11% compared to the same period last year. The gross margin was 53 million ron, up 20% compared to 3Q 2023, and EBITDA reached 13.5 million ron, +10% evolution compared to the same period of previous year. At 9 months, the operating profit recorded 5.8 million ron, similar to the 9-month period from 2023.

The non-operational (financial) result is a loss of 10 million ron, which includes a mark to market adjustment of Bittnet’s holding in Softbinator in the amount of 4.4 million ron. Thus, the gross result at 9 months is negative: -4.39 million ron.

Compared to the same period last year, in the first 9 months of 2024 we managed to streamline the sales by achieving a higher percentage increase in gross margin than in revenues: +20% margin vs +11% revenue. The operating profit on 30.09.2024 is substantially equal to that recorded in the similar period of last year, although the amount of depreciation is 20% higher than that on 30.09.2023, largely explained by the expansion of the consolidation financial perimeter of our group. The debt service brings an expense of 5 million ron.

As every time in recent years, we present the financial results of the group also from an annualized perspective (TTM) – the last 12 months closed 30.09.2024: during this period the total revenues amount to 405 million ron (up from 359 million compared to TTM 30.09.2023), the gross margin exceeds 75 million ron, up by 24%, and TTM operating profit stands at 12.4 million ron, approximately +18% compared to TTM last year, when it recorded the value of 10.5 million ron.

Starting this year, we have decided to provide a detailed quarterly view of the backlog, complete with delivery estimates until the end of 2024. Currently, the backlog amounts to approx.180 million ron , even if it will not be fully delivered until 31.12.2024. In addition to this backlog, we add the projects pipeline in various stages of bidding and negotiation, with an estimated value of over200 million ron. This integrated picture, along with TTM analysis, helps us provide a real perspective on our business continuity and the future of Bittnet group. I believe that this reporting format, carried out quarterly, best reflects the developments and our strategic projections on the business.

Our ambitions remain firm: to transform Bittnet into a regional and European player. This is a transformational process that we are planning for the period 2024 – 2027. Through various options for international development, including the listing of the Digital Infrastructure pillar (reorganized this year around Dendrio) on the Swedish capital market, we believe that we will be able to accelerate the process and strengthen our position in international markets.

One of the most important objectives of our group is to reward shareholders for their trust. In this sense, in the 3rd quarter, more precisely in August, we started the first BNET shares buyback program, according to the mandate granted by the shareholders in April. The program has a running period of 18 months from the date of registration of the EGMS Decision at the Trade Register, a term that began in May 2024. Through September 30th , 2024, we made daily shares repurchases from the market, a total of 1,822,931 shares. The purpose of this program is to cancel this shares so acquired by the issuer. The maximum number of shares that can be redeemed is 10 million, with a maximum allocated budget for this operation of 2 million ron. As of the date of publication of this report, we have exceeded 3 million redeemed shares (0.5% of the total number of BNET shares), which will be canceled under this program.

Although the transaction was not completed in the 3rd quarter, we would like to inform you that we have signed the contract for the sale of the majority stake in FORT SA, our cybersecurity pillar. We estimate that this transaction will contribute with 11.7 million ron to the financial results, in the form of financial profit, thus offsetting the mark-to-market revaluations and financial costs, resulting in a more close values of the net profit and the operating profit.

We are today a month and a half before the end of 2024, and in parallel we are in the final stages of delivering the projects planned for this year. Our priority is to implement the commitments we have made to our customers by the end of the year, and on this basis we remain confident that we will achieve the budgeted targets.

Thank you for your trust and continued support in achieving these goals.

As always, we are at your disposal for questions and feedback at the dedicated email address investors@bittnet.ro. Investors’ opinion is always important to us.

Mihai Logofătu,

Co-founder & CEO Bittnet Group